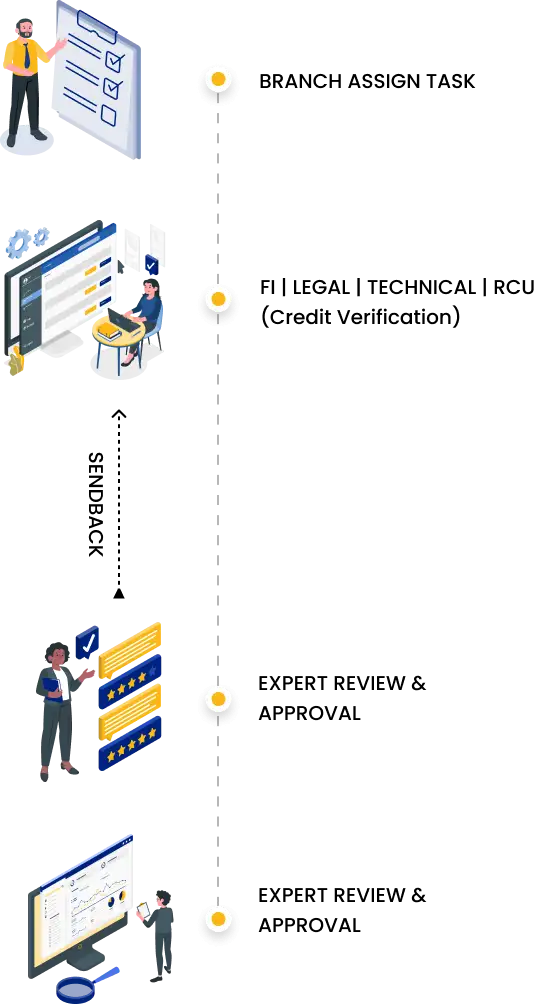

Verification Vendor Onboarding

Field Investigation (FI)

Legal Verification

Technical Verification

RCU Verification

Vendor Invoicing And Payout Update

Solutions For

Who Can Use

VMS Supports

Operations Team

Investigation Teams

Unit Team

Clients Who Trust Us

Building relationships, delivering excellence

Streamline Credit Verifications with Credility

In today’s fast-evolving lending ecosystem, accurate data, faster turnaround times, and strong regulatory oversight are critical to sound credit decisions. Credility’s Credit Verification Management Solution (VMS) helps banks, NBFCs, HFCs, and microfinance institutions modernize and centralize their entire credit verification lifecycle on a single, unified platform.

From field investigations and technical appraisals to legal checks and risk reviews, Credility VMS seamlessly connects branches, vendors, field agents, and risk teams. Built with mobile-first workflows, real-time dashboards, and secure integrations, the platform reduces operational delays, strengthens fraud controls, and accelerates loan disbursements—without compromising compliance.

Credility VMS is designed for regulated financial institutions that require accuracy, compliance, and operational control across the entire credit verification lifecycle.

A Unified Platform for All Verification Workflows

Traditional verification processes often rely on emails, spreadsheets, and disconnected tools, leading to delays, errors, and poor visibility. Credility VMS eliminates these challenges by offering an end-to-end system that manages every verification activity through standardized workflows.

Whether it’s property valuation, legal scrutiny, or background checks, the platform ensures consistency across processes. Mobile data capture, automated task allocation, SLA monitoring, and real-time escalations empower credit teams to make faster, data-driven decisions with complete transparency.

Field Investigation and Address Verification

Credility’s Field Investigation and verification App enables seamless on-ground verification for address checks, employment confirmation, reference validation, and risk assessments. Once a task is initiated, field agents instantly receive assignments on their mobile devices.

Agents can work both online and offline while capturing geo-tagged photographs, timestamps, location coordinates, and digital signatures. All data is securely synced to the platform, enabling structured reporting and automatic report generation. Reviewers can instantly analyze findings, flag discrepancies, and escalate cases where required—reducing backlogs and improving approval timelines.

Legal and Document Verification

Legal due diligence plays a crucial role in secured lending, particularly for mortgage and property-backed loans. Credility VMS simplifies legal verification by allowing branches to assign cases directly to empanelled advocates through the system.

Legal professionals upload title search reports, encumbrance details, opinions, and scanned documents directly to the platform. Status updates, alerts, and approval checkpoints keep all stakeholders aligned. Every action is logged with timestamps and user credentials, ensuring a strong audit trail while reducing dependency on emails and manual follow-ups.

Technical Appraisal and Site Validation

For lenders involved in construction finance, LAP, or project-based lending, technical appraisals are essential. Credility’s Technical Appraisal module supports engineers conducting site visits through a structured mobile workflow.

Using the app, technical experts can capture construction progress, site photographs, deviation notes, and measurements—each tagged with geo-location and time. Predefined templates aligned with institutional guidelines ensure consistency, accuracy, and standardized reporting across internal teams and external partners.

Advanced Technical Valuation Workflows

Credility’s Technical Valuation solution enables lenders to calculate property value, construction cost, and market estimates efficiently during sanction and post-sanction stages. Evaluators enter parameters such as built-up area, completion status, and location details into dynamic templates.

The system automatically computes values, identifies risk indicators, and generates structured valuation reports. Credit heads and risk managers can review, collaborate, and approve reports in real time—bringing speed, control, and consistency to valuation decisions.

Seamless Vendor and Partner Management

Credility VMS offers a structured and scalable vendor onboarding and management framework designed to support modern lending operations. Administrators can seamlessly onboard verification agencies, legal experts, and valuation partners by defining service geographies, SLAs, pricing structures, and required compliance documentation. Task assignments are intelligently automated using configurable rules such as pin code coverage, current workload, and historical performance.

When integrated with the creditpd app for lenders, this approach ensures that only verified, compliant partners are engaged in the credit process—helping institutions maintain stronger control, reduce operational overheads, and mitigate regulatory risk.

Invoice Management and Payment Tracking

Once verification tasks are completed and approved, vendors can raise invoices directly within the platform. Invoices are validated against task completion, agreed pricing, and applicable taxes through a maker-checker workflow.

Approved invoices are export-ready for ERP or finance system integration, reducing disputes, shortening payment cycles, and improving vendor satisfaction—making your institution a preferred partner in the verification ecosystem.

Real-Time Dashboards and Operational Visibility

Credility’s intelligent dashboards provide end-to-end visibility across all verification activities. From pending cases and SLA breaches to vendor performance and regional trends, every metric is tracked in real time. Credit teams and management can filter insights by geography, verification type, vendor, or risk category. Automated alerts and escalations help identify bottlenecks early, improve workload distribution, and strengthen fraud detection.

RCU and Special Investigation Support

The platform also supports advanced RCU workflows for second-level checks and fraud investigations. Investigators can access borrower data, capture findings, and submit structured reports using the Field Investigation and verification App.

Customizable report formats allow institutions to tailor investigations for different products such as SME loans, personal loans, or affordable housing finance. All findings are seamlessly linked back to the LOS, enriching decision-making engines with verified intelligence.

Key Benefits of Credility VMS

-

Faster Turnaround:

Reduce verification TAT by up to 40% with automated workflows and mobile data capture -

Operational Savings:

Lower printing, courier, and manpower costs through digitized processes -

Stronger Compliance:

Geo-tagging, audit logs, and digital trails ensure full traceability -

Higher Accuracy:

Standard templates and review checkpoints minimize errors and rework -

Improved Vendor Experience:

Transparent invoicing and timely payments strengthen partnerships

Built for Scale, Security, and Integration

Credility VMS is a cloud-hosted, API-driven platform with end-to-end encryption, role-based access controls, and ISO-aligned security standards. It integrates seamlessly with LOS, CRM, and core lending systems, including deployment alongside a creditpd app for lenders to strengthen credit decision workflows. Designed to scale effortlessly, the platform supports institutions managing hundreds or thousands of verifications monthly—while ensuring high availability, business continuity, and performance reliability.

Start Smarter Credit Verification Today

If manual processes and fragmented systems are slowing down your verification cycle, it’s time for a smarter approach. Whether you need a powerful Technical Appraisal solution or a reliable Field Investigation and Verification App, Credility VMS is built to support modern lending operations.

Get in touch today for a personalized demo and see how Credility can help you drive faster approvals, stronger risk controls, and better portfolio outcomes.

Insights

Journey into insightful perspectives

Ready to Transform?

Get a personalized demo now. Contact our team today!