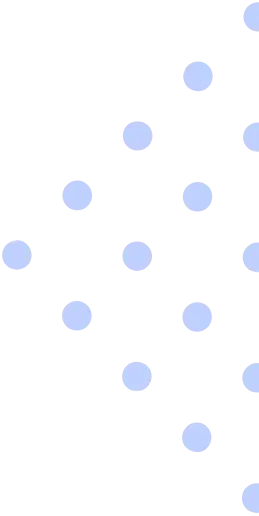

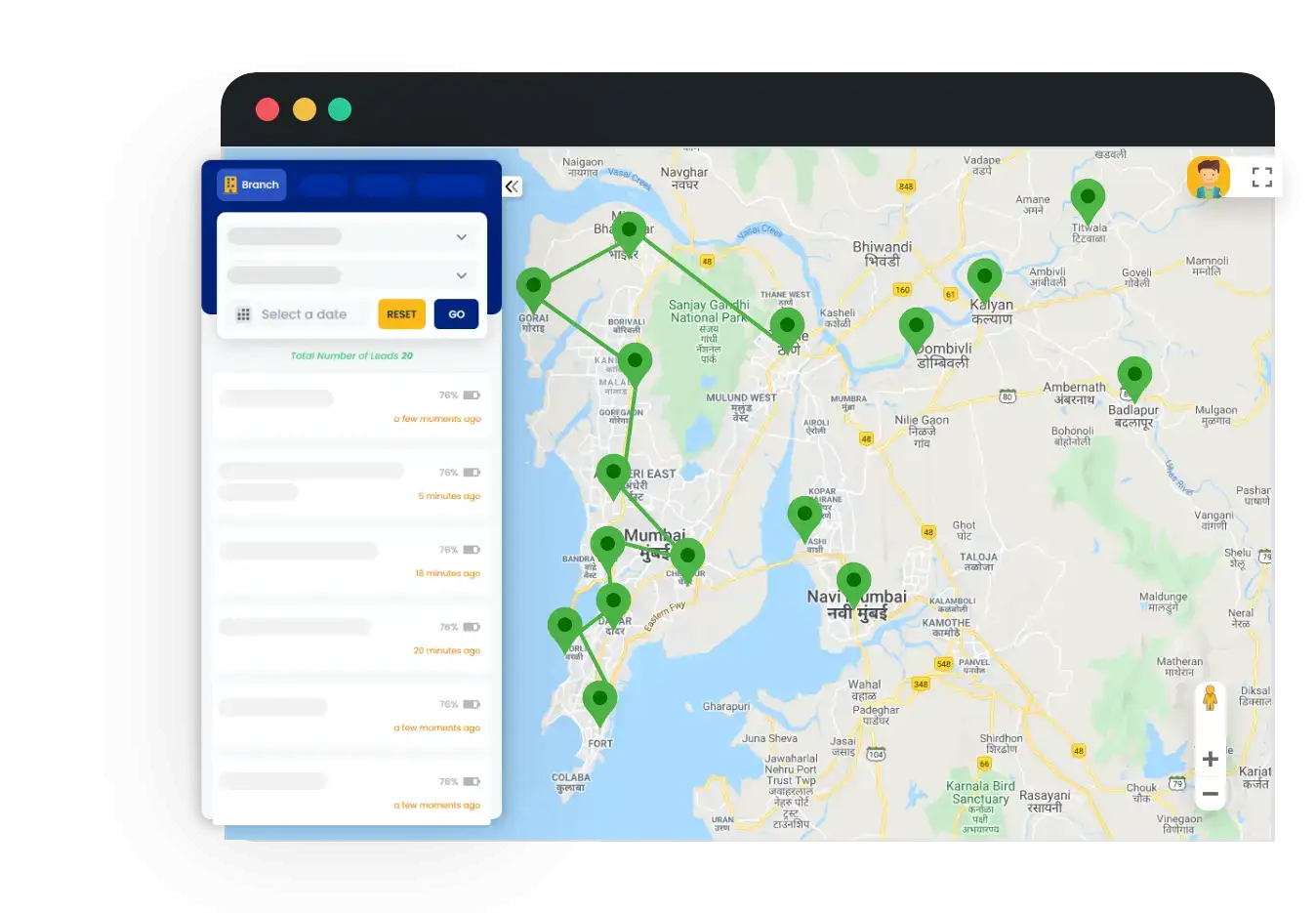

Onfield RM And TL Login File App

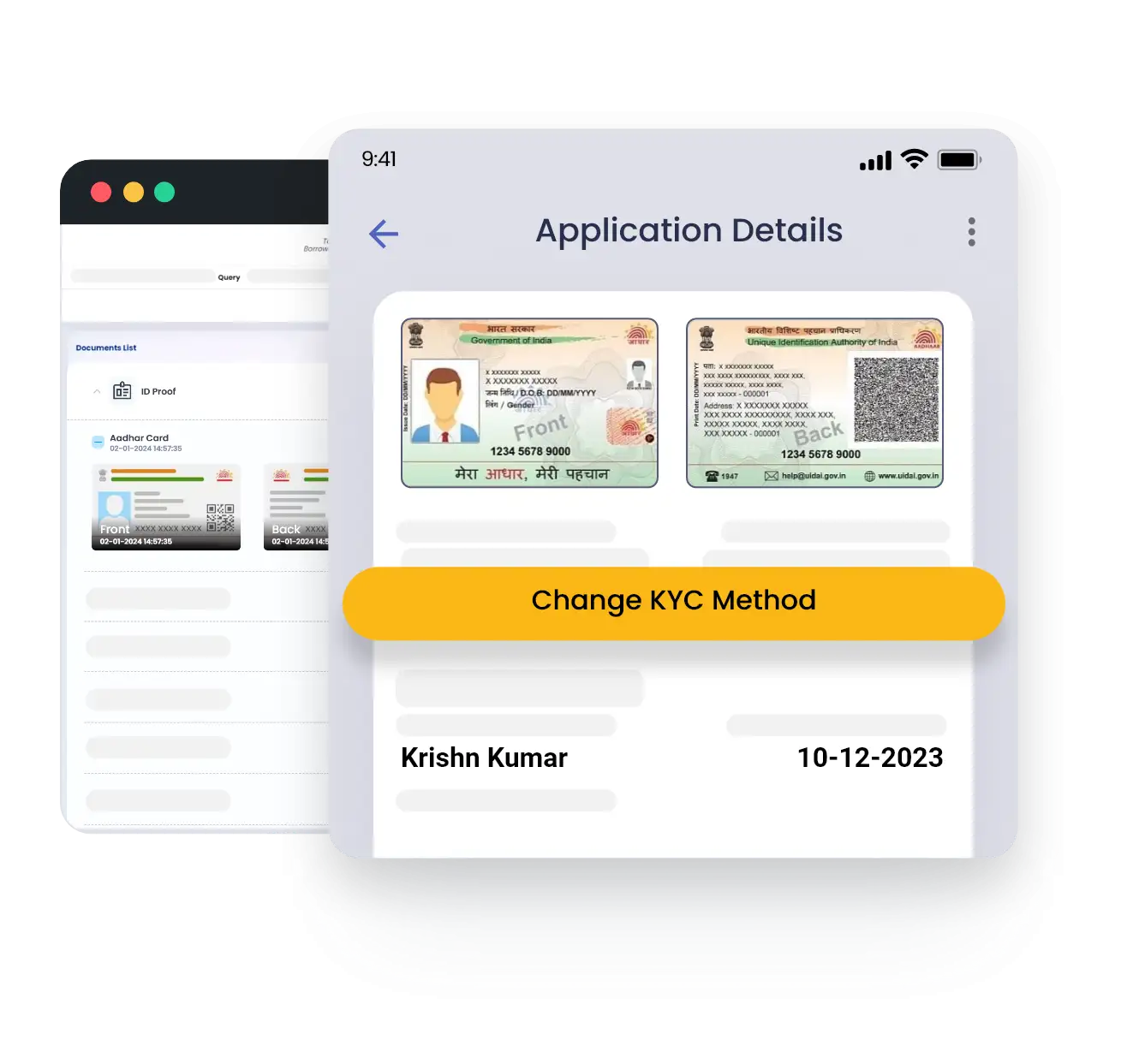

Paperless Onboarding

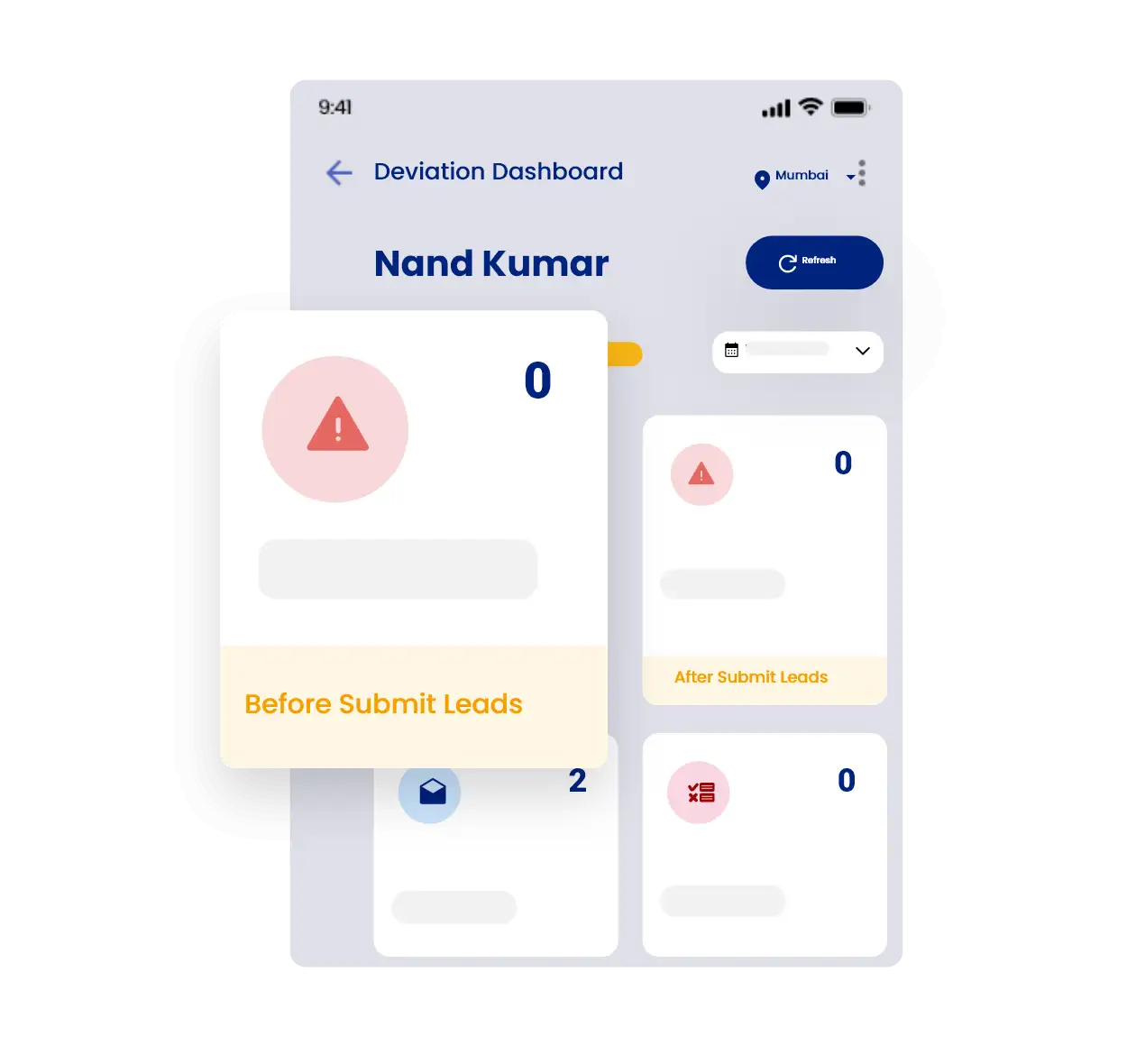

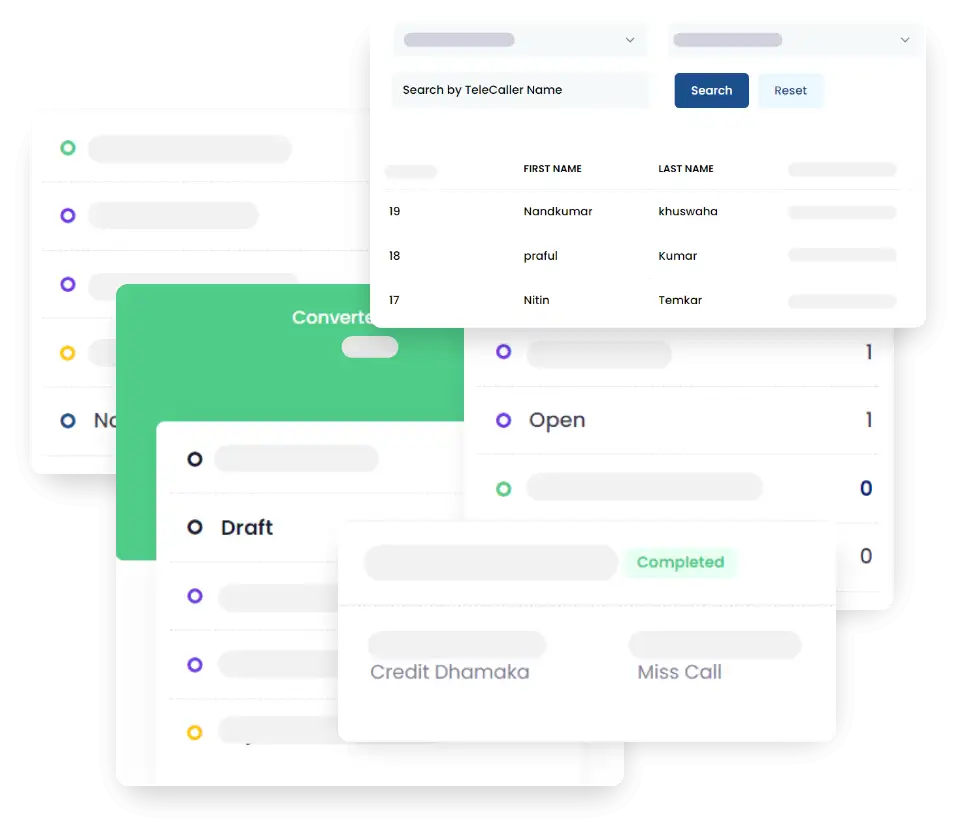

Wavier And Deviation Approval Management

Login File Review Checker Panel

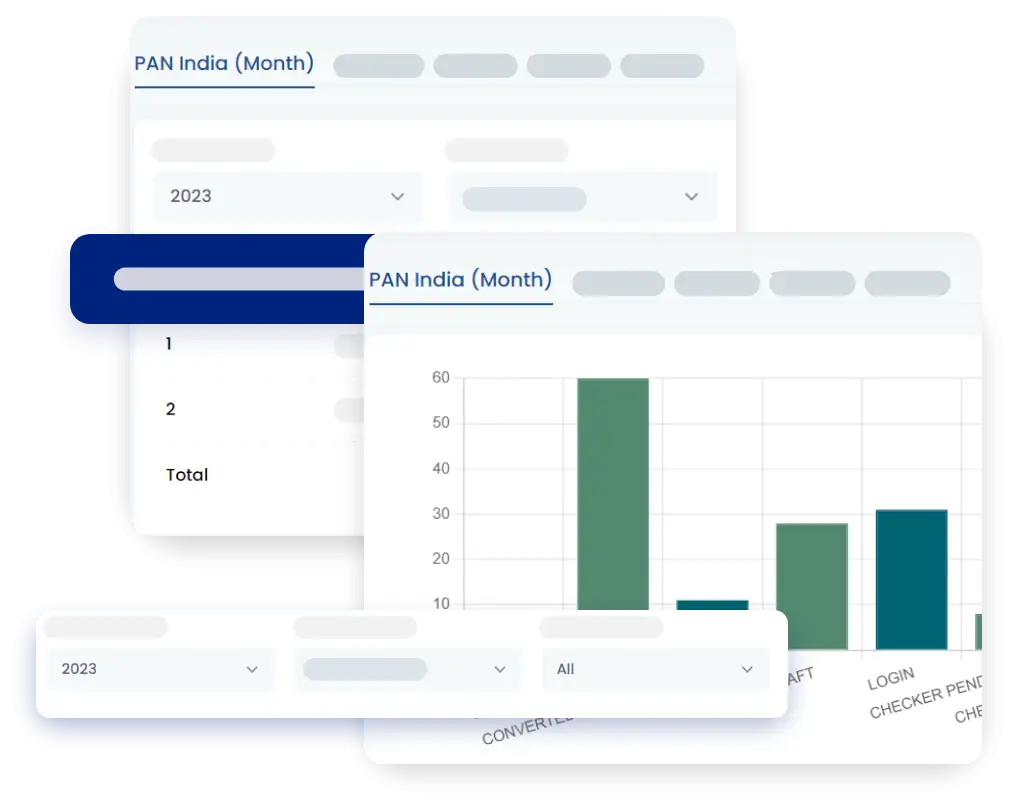

Performance Dashboard

Multiple Integrations

Integrated with 17 + 3rd-party APIs for faster onboarding

Solutions For

Who Can Use

go FTR Customer Onboarding Software supports

officer

/Credit

Clients Who Trust Us

goFTR Customer Onboarding Software and Lead Management Made Easy

Credility’s goFTR is a mobile-application-based loan sourcing app solution. Banks and credit institutions are constantly looking for hassle-free, paperless ways to manage leads, qualify applicants and quickly onboard potential borrowers. Our Paperless Customer Onboarding Software is a fully automated, API-driven Customer Onboarding Platform that provides an end-to-end solution for banks and other financial institutions.

With access to goFTR, the sales team can complete eKYC, gather applicant information and collect documents in real time through our customer onboarding system. Built by a team of developers and domain experts, this platform offers enterprise-level reliability and customization, making it a strong digital onboarding solution for lending organizations. It enables end-to-end lead execution through a single mobility Sales Assist app for Lending Companies in India. Credility’s goFTR solution provides a simple, step-based and gamified experience for filing a complete loan application. Details entered offline are saved as drafts, ensuring no important information is ever lost.

Why Opt for Digital Customer Onboarding Platform by Credility?

Credility’s goFTR Customer Onboarding Software performs all regulatory checks, ensuring financial institutions maintain 100% compliance. Our digital onboarding capabilities help institutions accelerate the customer onboarding process.

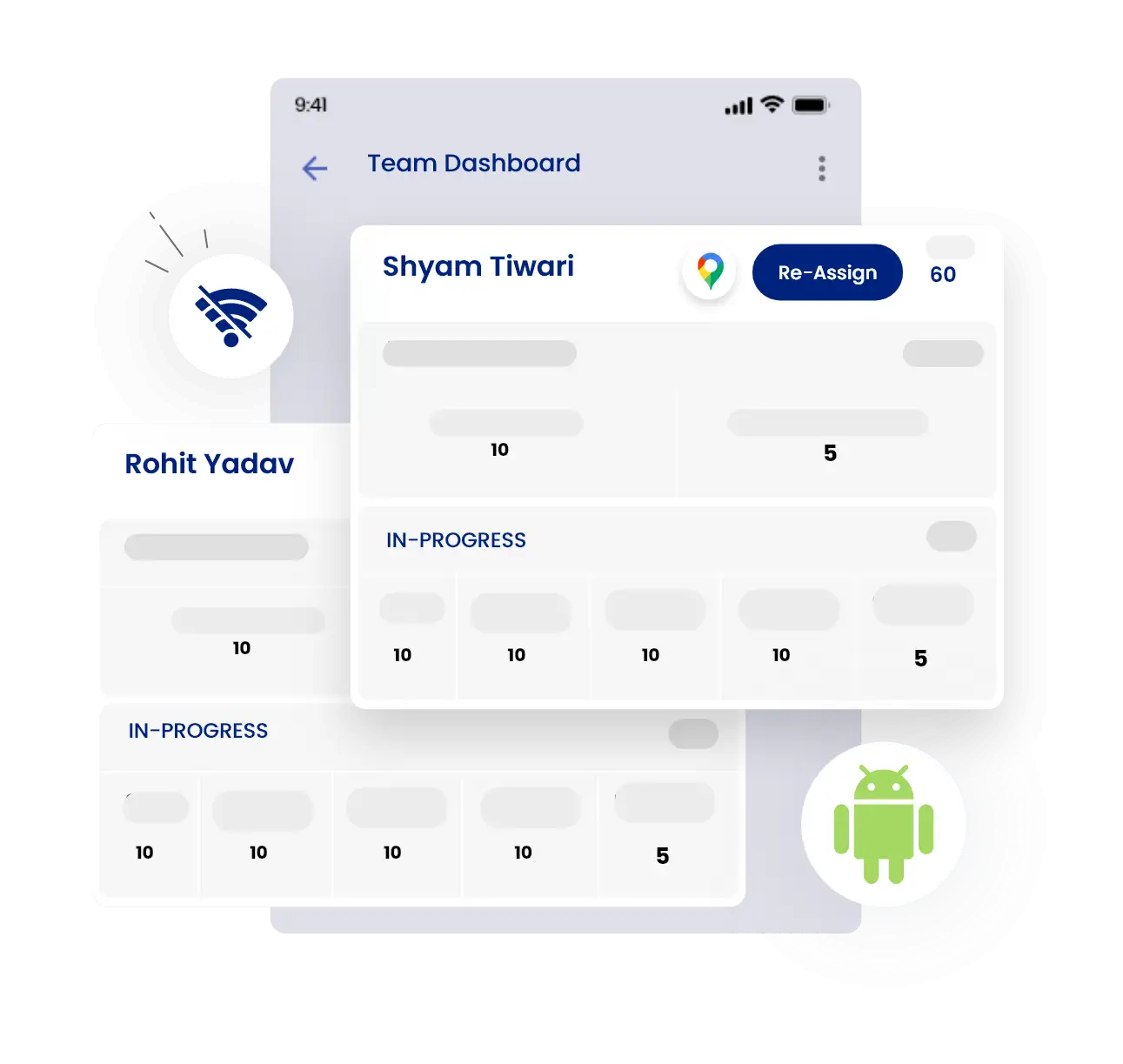

- Integrated with more than 10 third-party APIs—PAN, Aadhaar, Voter ID, Driving Licence, CKYC, Credit Bureau Check, Payment Gateways and others—to streamline eKYC.

- Enables quick and secure sharing of sensitive documents. The Digital Account Opening Solutions allow applicants to upload required documents safely.

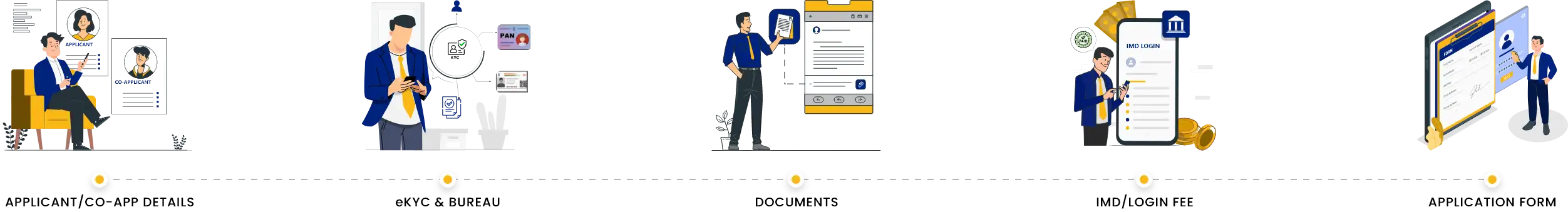

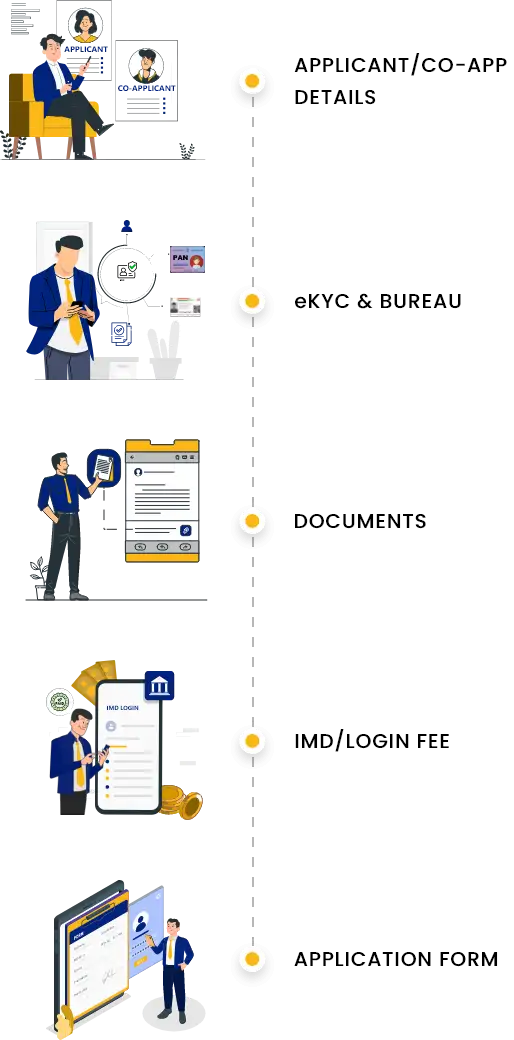

- Simplifies customer onboarding. Using the Sales Quick Login File App, the sales team can onboard customers digitally in just 10 steps.

- Applicant verification made easy. Identity authentication and document verification can be completed instantly through our Paperless Customer Onboarding Software.

- Allows organizations to deliver a personalized onboarding experience to every customer through goFTR.

Salient Features of Our Digital Account Opening Solutions

- Sales Optimization

- Real-time insights

- Transparency in team performance

- End-to-end lead nurturing

How Financial Institutions Benefit from our Customer Onboarding Platform

-

Measure sales performance:

Track individual and team performance using powerful analytics tools within the loan sourcing app. Maximize sales coverage, gain visibility on nearby unscheduled leads and enhance productivity through the Sales Assist app for Lending Companies in India. -

Lead nurturing:

Every stage of customer acquisition—from assessing applicant credibility to monitoring customer conversion—can be efficiently managed using our Customer Onboarding Platform. -

Automated data entry:

Our Customer Onboarding Software Solutions can auto-fill maximum information about the applicant to speed up the onboarding process. On the basis of their-party integration and master driven approach, the goFTR solution from Credility helps the credit managers at financial institutions to pre-populate as much data about the customers as possible and invest less time in data entry.

Insights

Journey into insightful perspectives

Ready to Transform?

Get a personalized demo now. Contact our team today!