Allocation And Planning

Assign the right owner to handle each overdue case,

so no PTP follow up gets dropped.

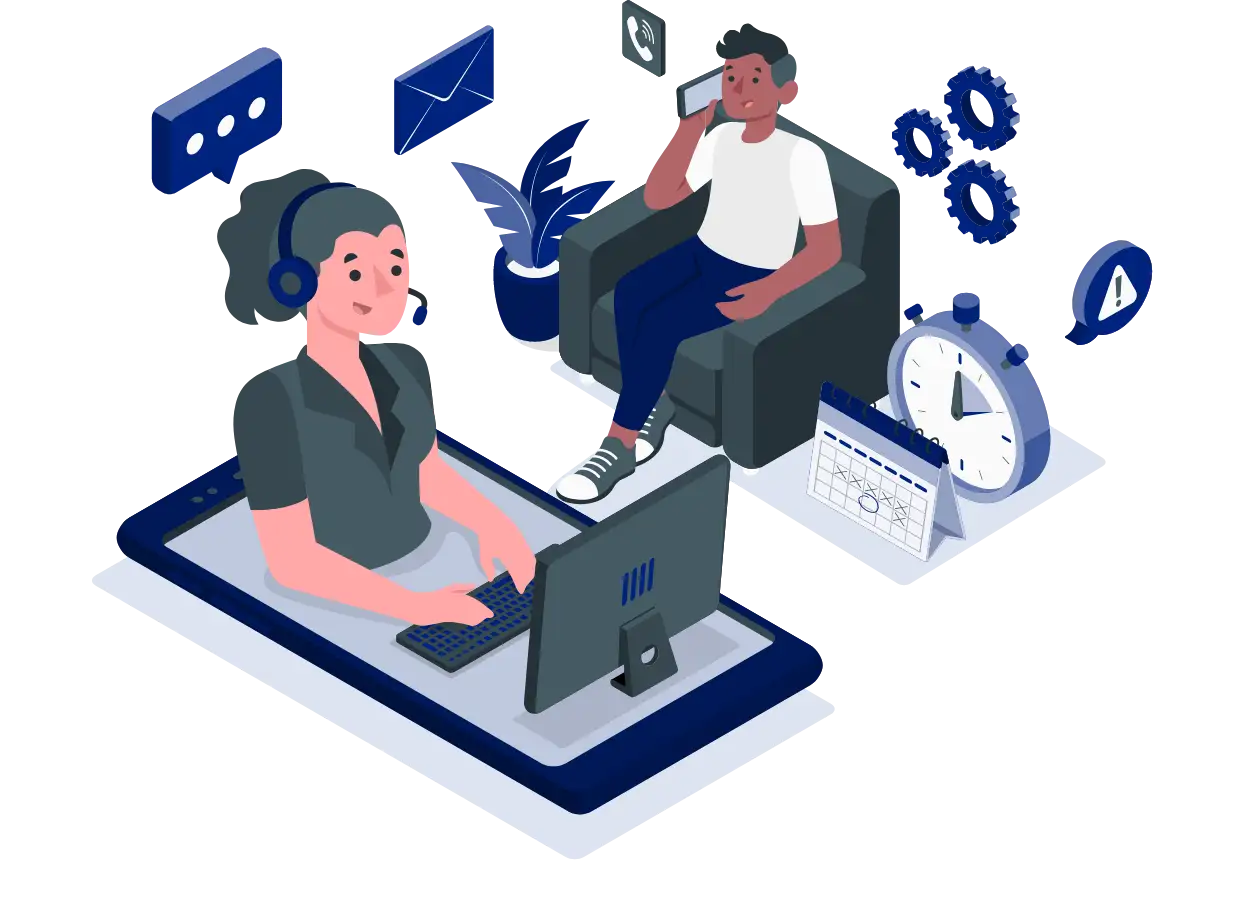

Multi-Channel Digital Reminders

Use different modes of communication to easily

schedule & automate communication with our borrowers.

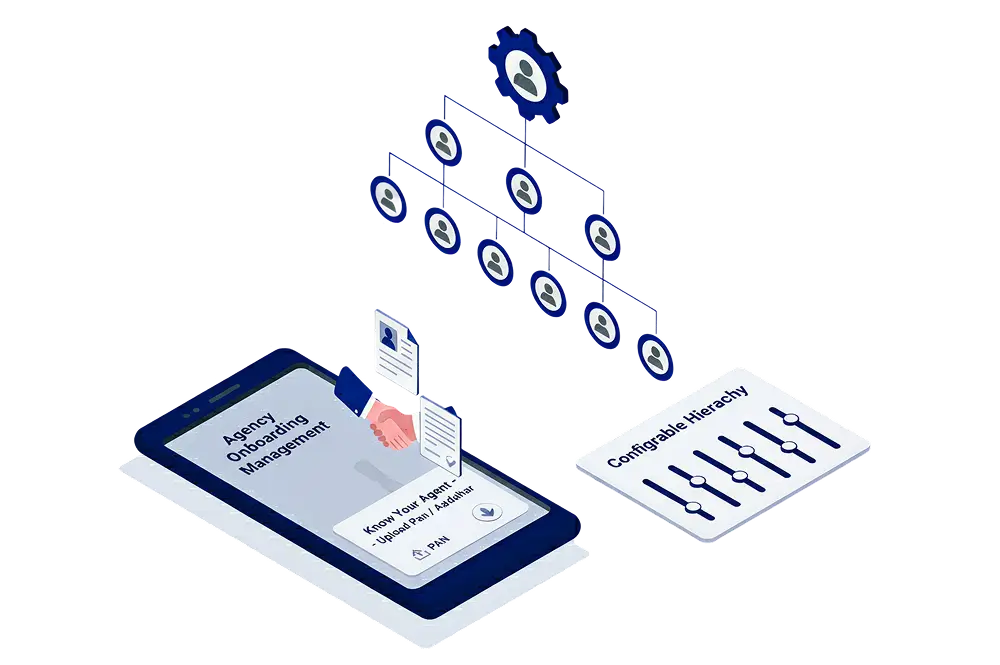

Multi-Business Units & Hierarchy

Tele Collections

Personalized assistance, exceptional service : our telecallers connect you to tailored solution for with care and expertise.

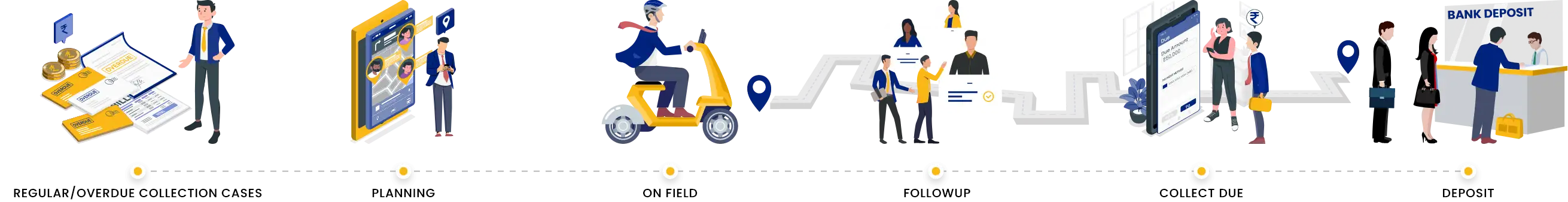

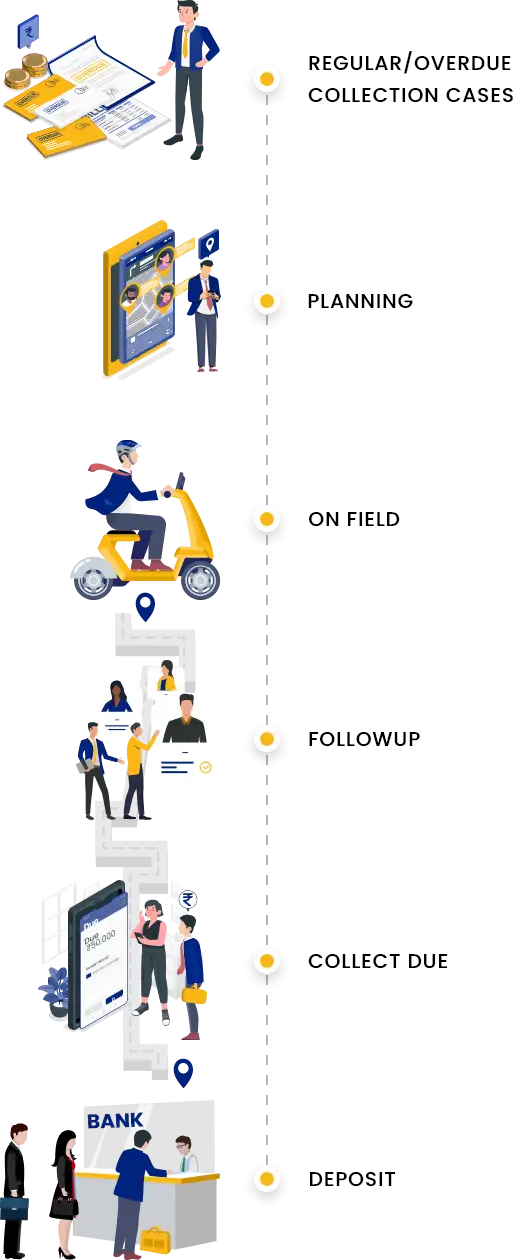

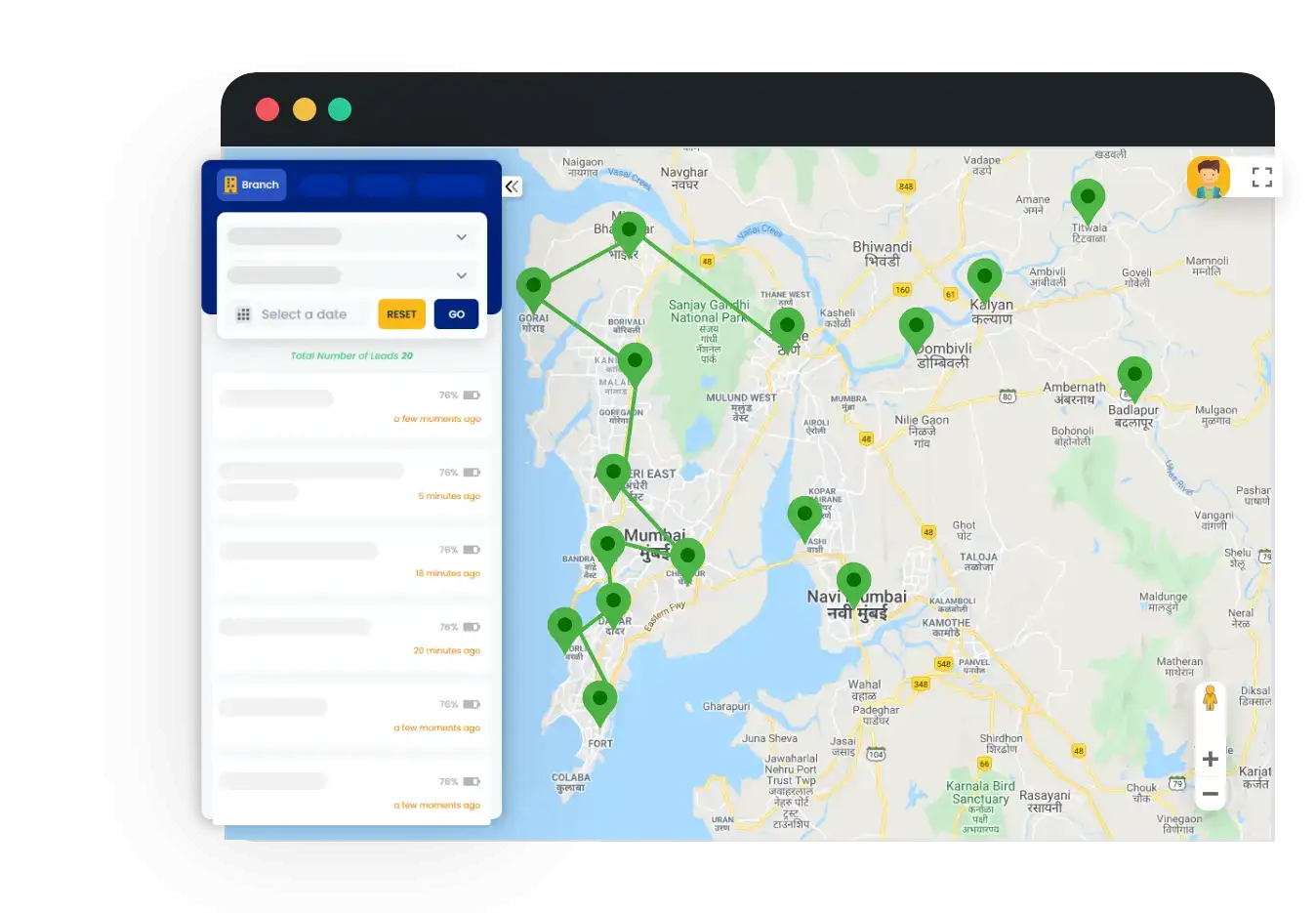

Field Collections

Empowering agents on the go : our app simplifies on-field tasks, enhancing efficiency and real-time decision making.

Settlement Waiver Module

Seamless process of loan settlement and waiver process with configurable approval matrix available.

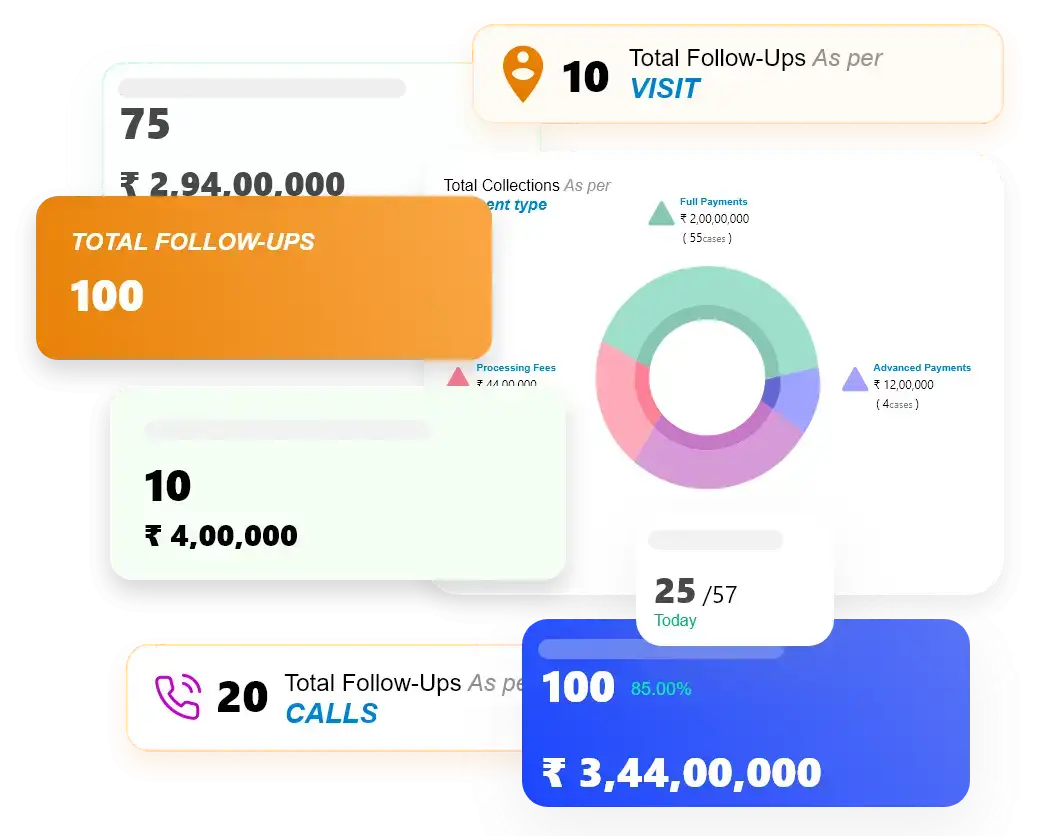

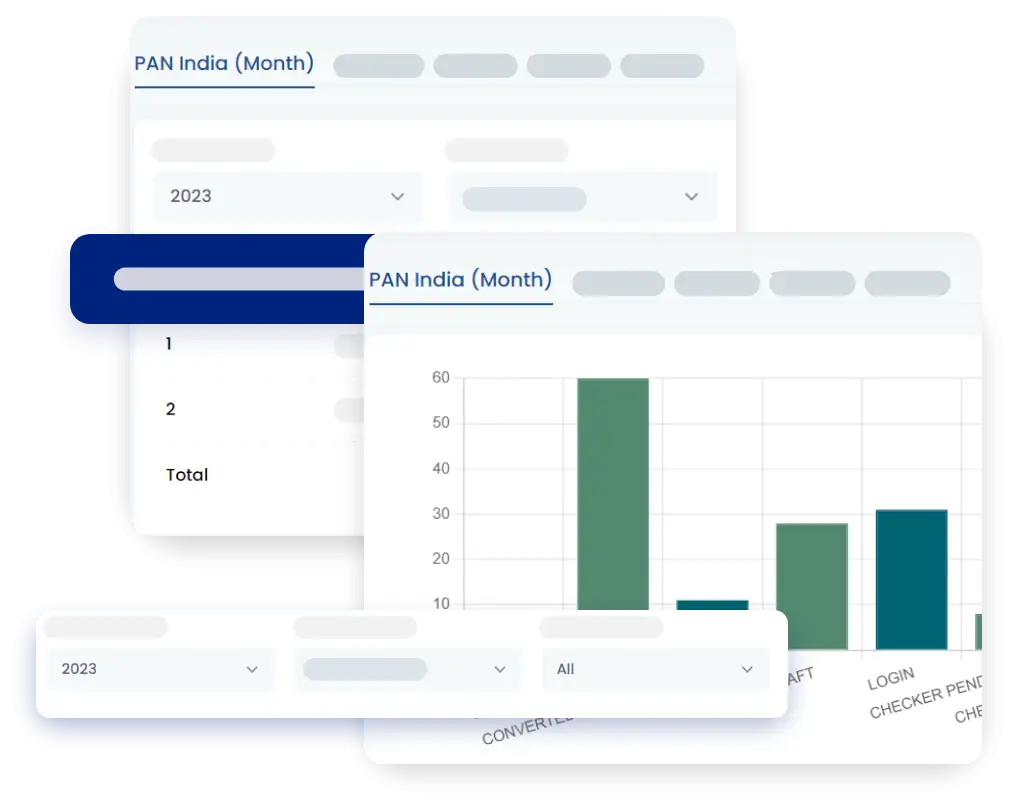

Performance Dashboard & Reports

Monitor progress and gain insights with our performance dashboard & reports. Visualize data for informed decisions.

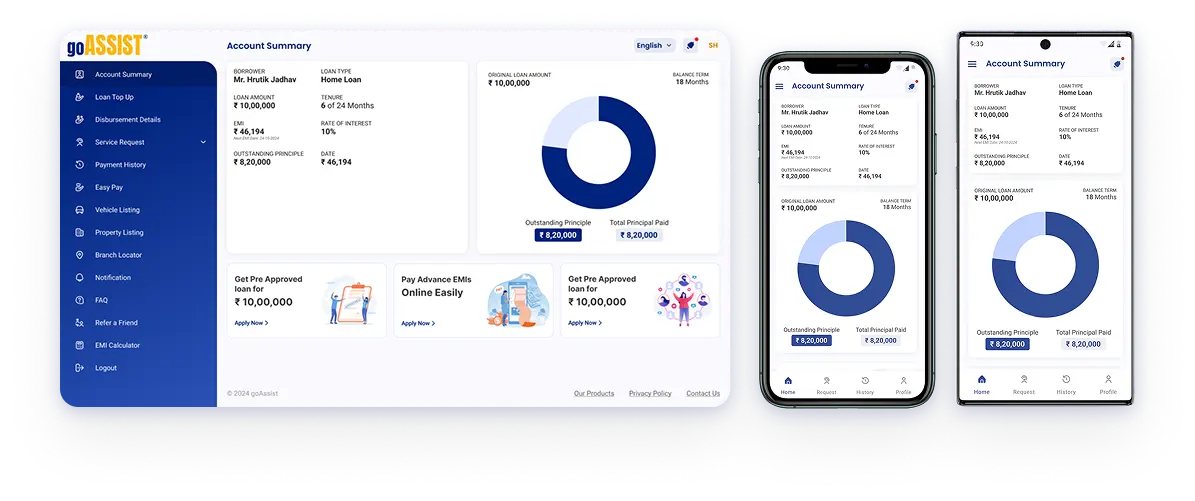

Customer Service

Multiple Integrations

goCollect seamlessly integrates with the excellent tools on your existing platform

Solutions For

Who Can Use

goCollect Debt Collection Software Supports

Collector

Collector

Agency

Covering All Collections

Safeguarding your precious collectibles with confidence

Clients Who Trust Us

Building relationships, delivering excellence

Frequently Asked Questions

We have put together some commonly asked questions

Can I track the number of collection done by the collector in a day?

Can I integrate goCollect App with my LMS?

Can I integrate the online payment gateway of my choice?

Can I know if the collector has visited the customer in person?

Can the supervisor or telecaller assign PTP pickup cases to Feet on Street (FOS)?

Can I manage my recovery team hierarchy in the goCollect App?

Can the collector send an acknowledgement of collection receipt through SMS / Email in image or pdf format?

Will the collector be able to sort the view of cases by number of hard / soft bucket cases?

Can the on-field collection officer collect payment from customers staying in the remote area where there is network problems?

How many payment modes are available in goCollect App? Is there an option to collect digital payment?

A transparent debt collection software and recovery app designed to make collection easier

goCollect is an innovative debt collection software solution that enables efficient payment collection. This digital tool is introduced in the market by Credility, one of the leading pioneers in the world of online financial services. It seamlessly automates the tedious task of tracking performance, following up with debtors, predicting and prioritizing debt recovery to enable faster, smoother and stress-free collections for NBFCs, banks and other financial lending institutions. As an automated debt collection technology, it helps institutions streamline their on field and digital collection processes.

Conventionally, lending institutions had to rely on third-party collection agencies for debt recovery from borrowers. The goCollect on-field loan collection app by Credility reduces this dependency and takes care of everything—from sending timely payment reminders to offering various payment terms to borrowers. Having access to a digital debt collection platform like goCollect can significantly help control overdue collections and escalate repayment percentage for financial institutions, making it a reliable debt recovery platform and cash collection software for NBFC operations.

Features of the goCollect Debt Collection Mobile App

Financial lending institutions, banks and NBFCs are required to maintain a portfolio of their borrowers. goCollect is a debt collection mobile app that is customizable to an institution’s specific requirements and works as a complete debt management software for on-field teams.

-

Multi-level hierarchy

This feature of our debt collection management software is designed to closely monitor team performance. The app tracks each collection agent’s productivity individually as well as at the team level. The interactive dashboards and drill-down reports enable on-field collection with real-time updates, making it an efficient debt collection platform for institutions. -

Case allocation

The app analyses the borrower’s profile and intelligently allocates the right collection agent. This ensures every overdue case is handled with priority so that no PTP (promise-to-pay) follow-up gets dropped. Traditionally, managers had to manually control case allocation. goCollect by Credility brings a smart, automated approach and ensures on-field collection agents attend to high-priority debtors first. This capability strengthens it as one of the most efficient debt collection platforms in India. -

Auto-receipt generation

goCollect, as a modern automated debt collection software, generates and sends receipts to customers automatically once the payment is completed. Receipts can be triggered in real-time via SMS or email. Institutions can also print hard copies if required. The app ensures a smooth payment process with multiple options like cash, cheque, demand draft, online transfer, bank transfer and UPI.

A Debt Collection Management Software manages the overall debt management process

goCollect is a comprehensive digital debt collection system where a financial lending institution can maintain all customer data in one place. This centralization makes tracking, management and follow-ups significantly easier. Banking institutions can also identify and monitor high-priority debtors with all the required data available on one screen. The debt collection system also tracks overdue collection performance and provides real-time dashboards to help companies optimize their bottom line. Locating and monitoring the daily activities of an on-field collection officer becomes seamless with intelligent data insights from this reliable debt collection software solution by Credility.

Insights

Journey into insightful perspectives

Ready to Transform?

Get a personalized demo now. Contact our team today!