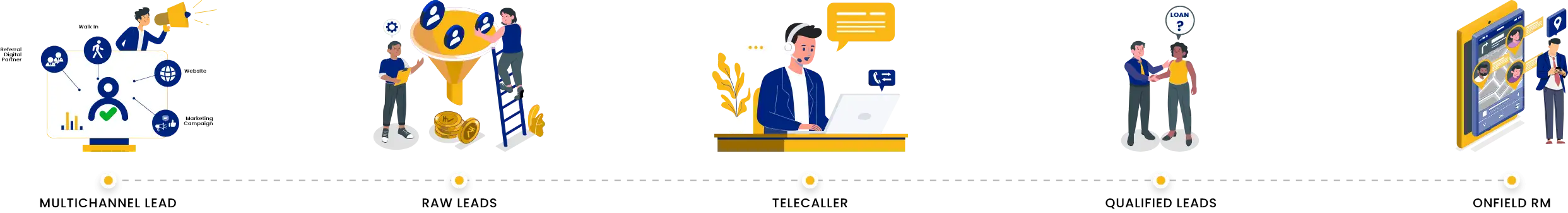

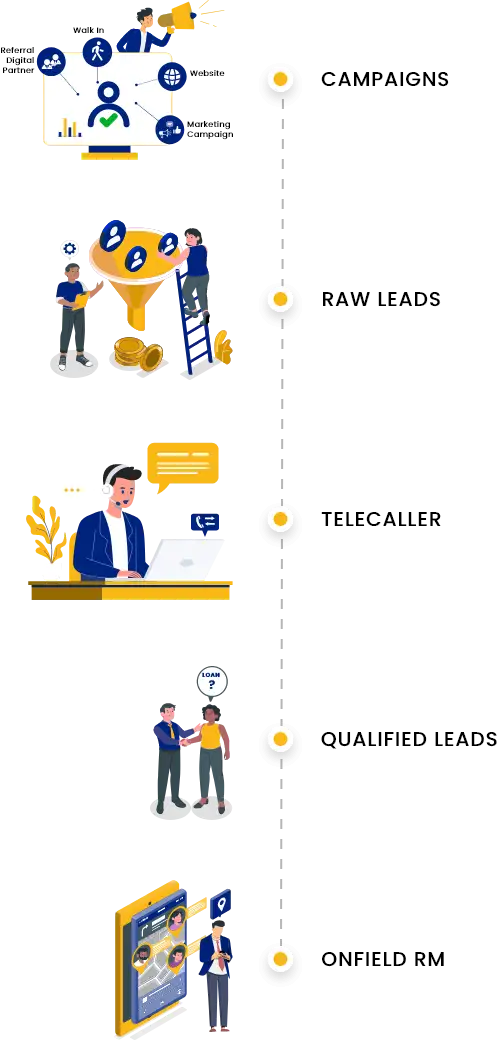

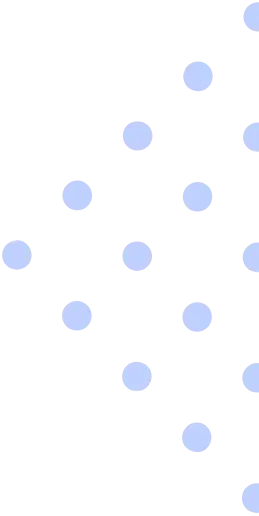

Multi-Channel Campaign Leads

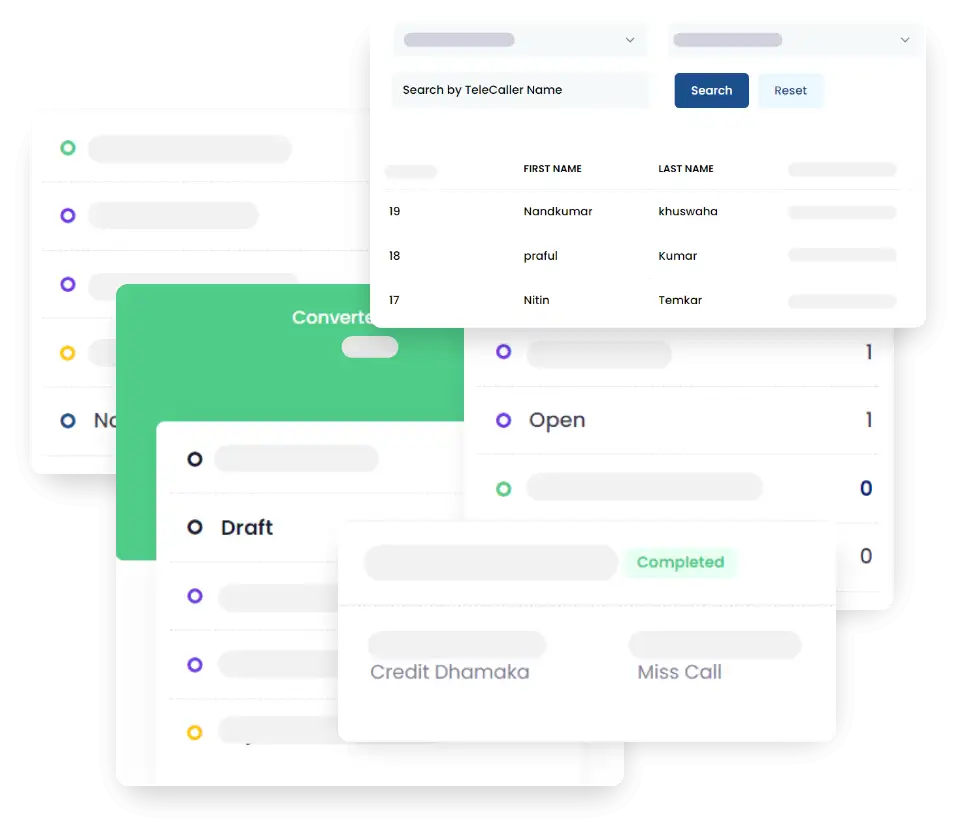

Telecaller Module

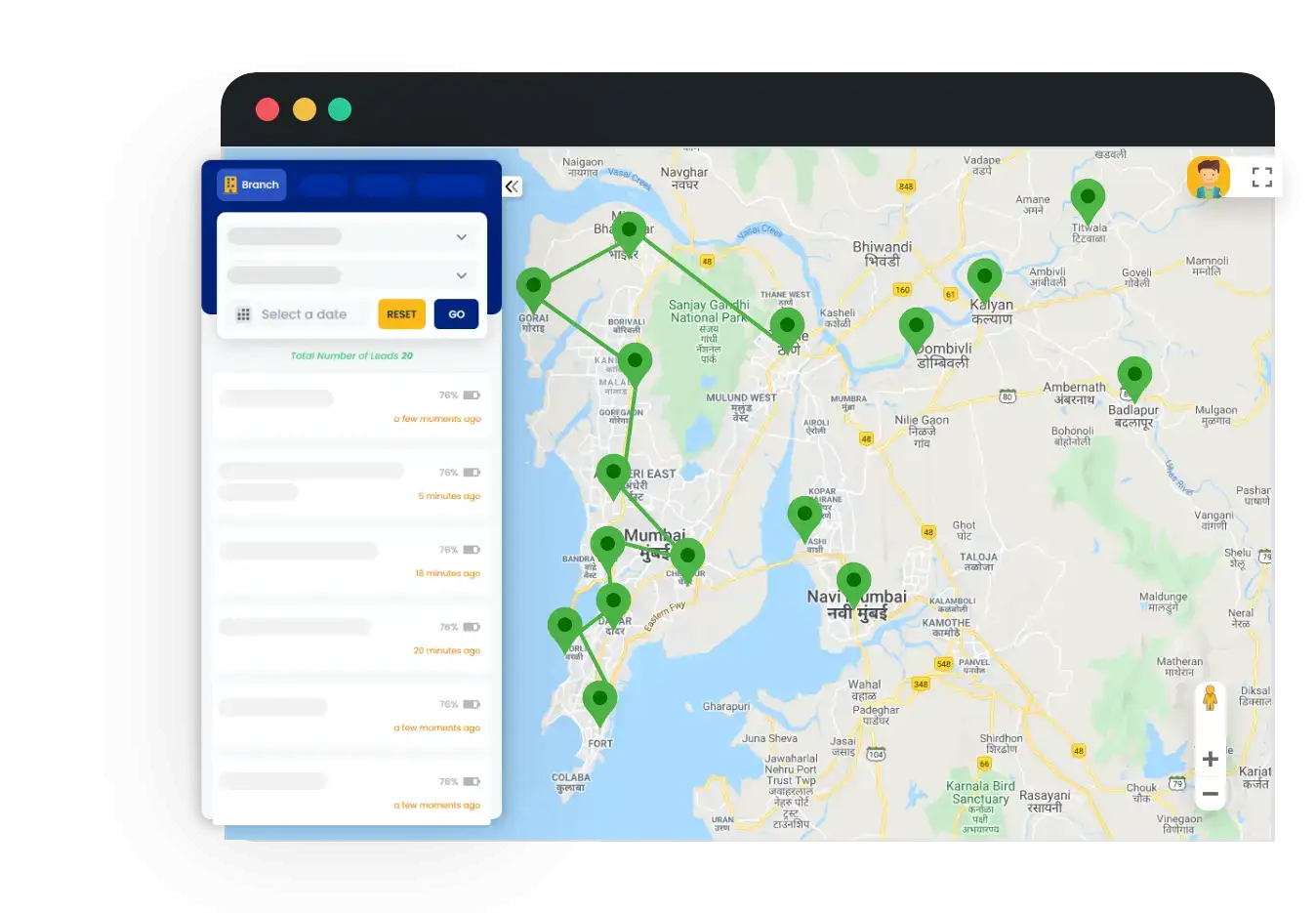

Onfield RM and TL Lead Sourcing App

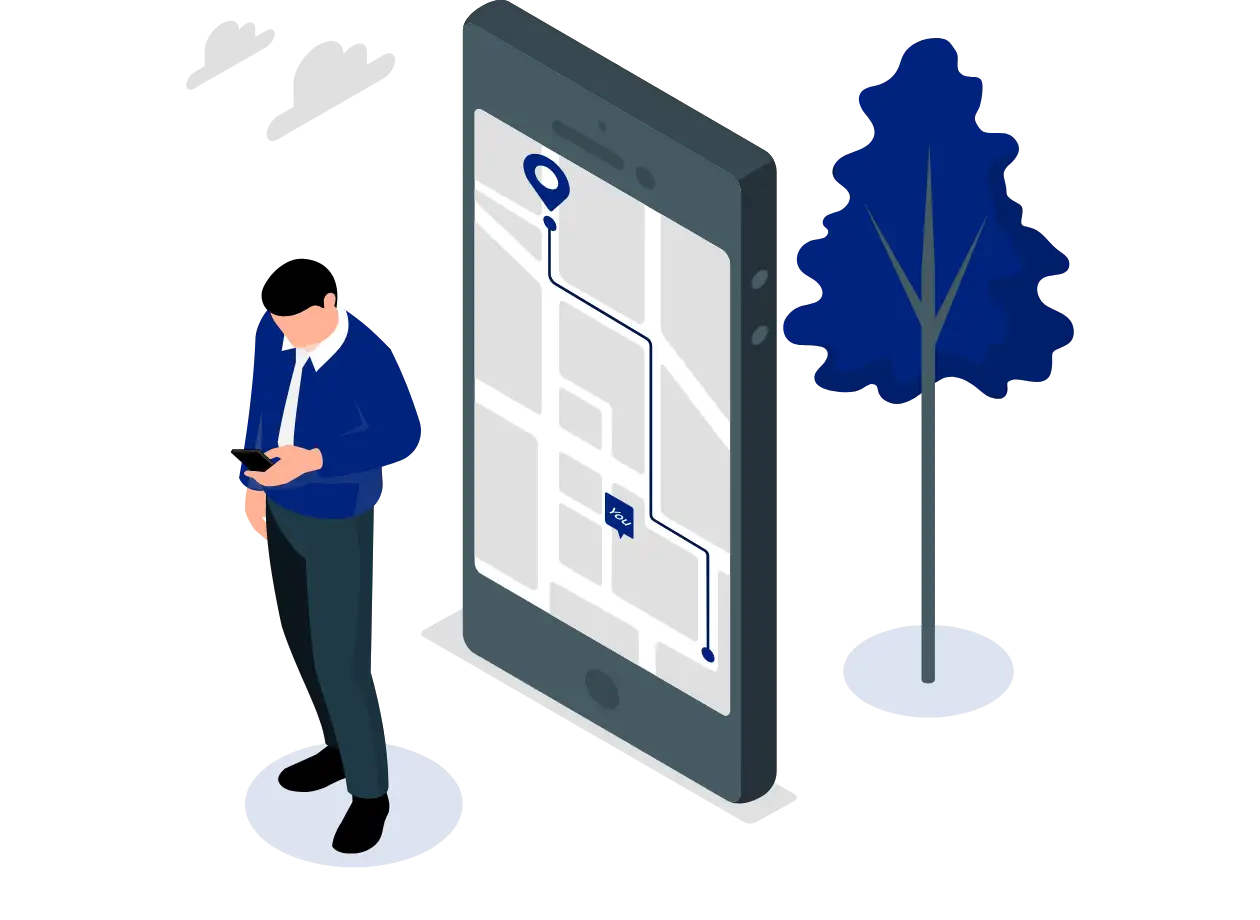

Channel Partner Onboarding And Lead Sourcing.

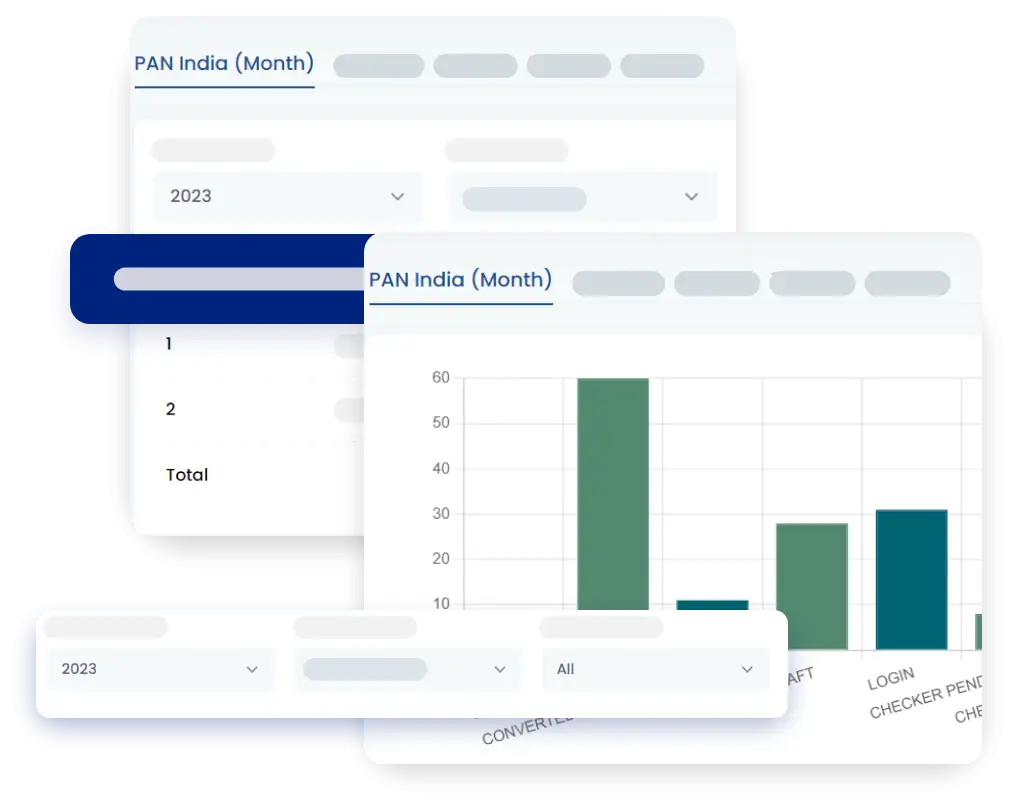

Performance Dashboard

Multiple Integrations

Solutions For

Who Can Use

goConnekt supports

caller

loan officer

Clients Who Trust Us

Get a pulse on your entire lead management cycle with our advanced Lead Management App.

goConnekt is a comprehensive, integrated, customisable, cutting-edge solution curated to manage the complete sales lead pipeline. The lead management app for BFSI by Credility empowers the lending institution to optimise their operational risk and reduce manual intermediation to strengthen their workflow. It is a single software that is designed to centralise your multi- channel leads on one platform. Credility is an industry pioneer in enabling advanced cutting-edge, comprehensive lead management software and providing improved sales productivity. It is an ideal solution for Banking, Financial Services and Insurance sector to engage with their leads on the go.

goConnekt keeps a track of your lead’s every move to scale your lead conversion ratio exponentially. The real-time performance dashboard helps financial lending companies to monitor the performance of their sales team on an individual level and group level to monitor a healthy sales pipeline. With Credility’s goConnekt app, saving precious time and money for your organisation will be a cakewalk. It is easier to strategise and take fruitful actions when one takes informed decisions. The interactive dashboard of goConnekt enables lending companies to visualise their monthly performance and take measures accordingly.

Issues resolved by Credility’s Lead Management App for BFSI

- The tedious and time-consuming paperwork, data entry and administrative tasks involved in manual lead management. goConnekt is a mobile application that digitally enables a complete lead management process with more precision and less human error.

- goConnekt is the Lead Management App for BFSI that cuts down the longer sales cycles. The dashboard consolidates all the leads from multiple channels and platforms under one platform and prevents lead leaks, so no lead goes unnoticed. This cutting-edge technology helps the sales team convert leads faster than ever.

- goConnekt helps the financial lending institutions to allocate the right team member to handle the potential customers.

- Lead leakage can be effectively prevented by channelling leads for all the channels under a single platform. It prevents lead loss and leakage and increases their visibility to the financial lending institutions.

A software solution that is designed to expand your business rapidly and help innovate

-

goConnekt offers a plethora of benefits to the BFSI, NBFCs and other financial

institutions. Some of them include-

- Seamless and personalised customer experience.

- Optimised sales pipeline that eventually results in improved conversion rates.

- High transparency of the performance and sales activity due to real-time monitoring dashboard.

-

Increased field sales productivity

Salient Features of goConnekt:

- Lead Analytics dashboard: It analyses and tracks the lead management process right from sales performance, lead origin, team productivity, lead status and progress, as well as conversion statistics.

- Lead Allocation: Financial lending institutions can map their leads and distribute their tasks and overdue cases among the deserving members best suited for the job without overburdening them.

- Lead tracking: Credility enables lead tracking attributes that make the leads more discoverable in every phase, providing better follow-ups and conversions.

- Interactive dashboard: The interactive dashboard of goConnekt visualises monthly performance allowing the lending companies to stay on top of sales.

Insights

Journey into insightful perspectives

Ready to Transform?

Get a personalized demo now. Contact our team today!