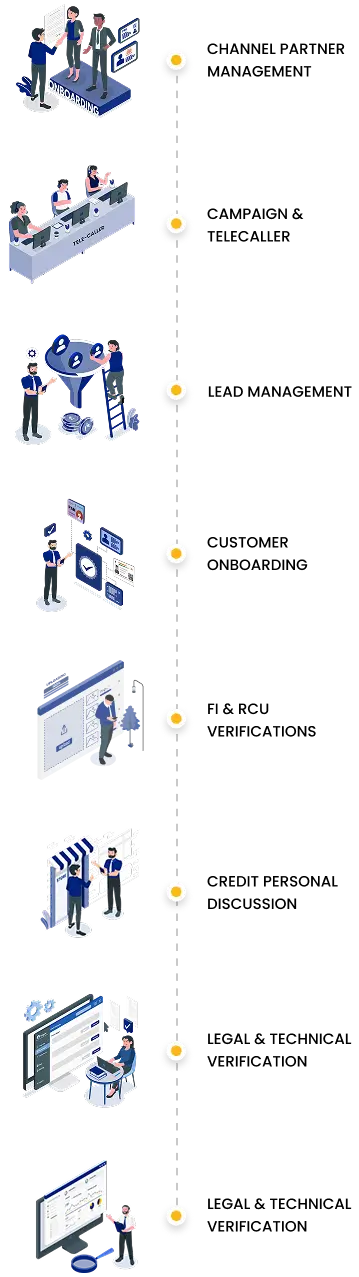

Channel Partner Management

Campaign & Telecaller

Lead Management

Customer Onboarding

FI & RCU Verifications

Credit Personal Discussion

Legal & Technical Verification

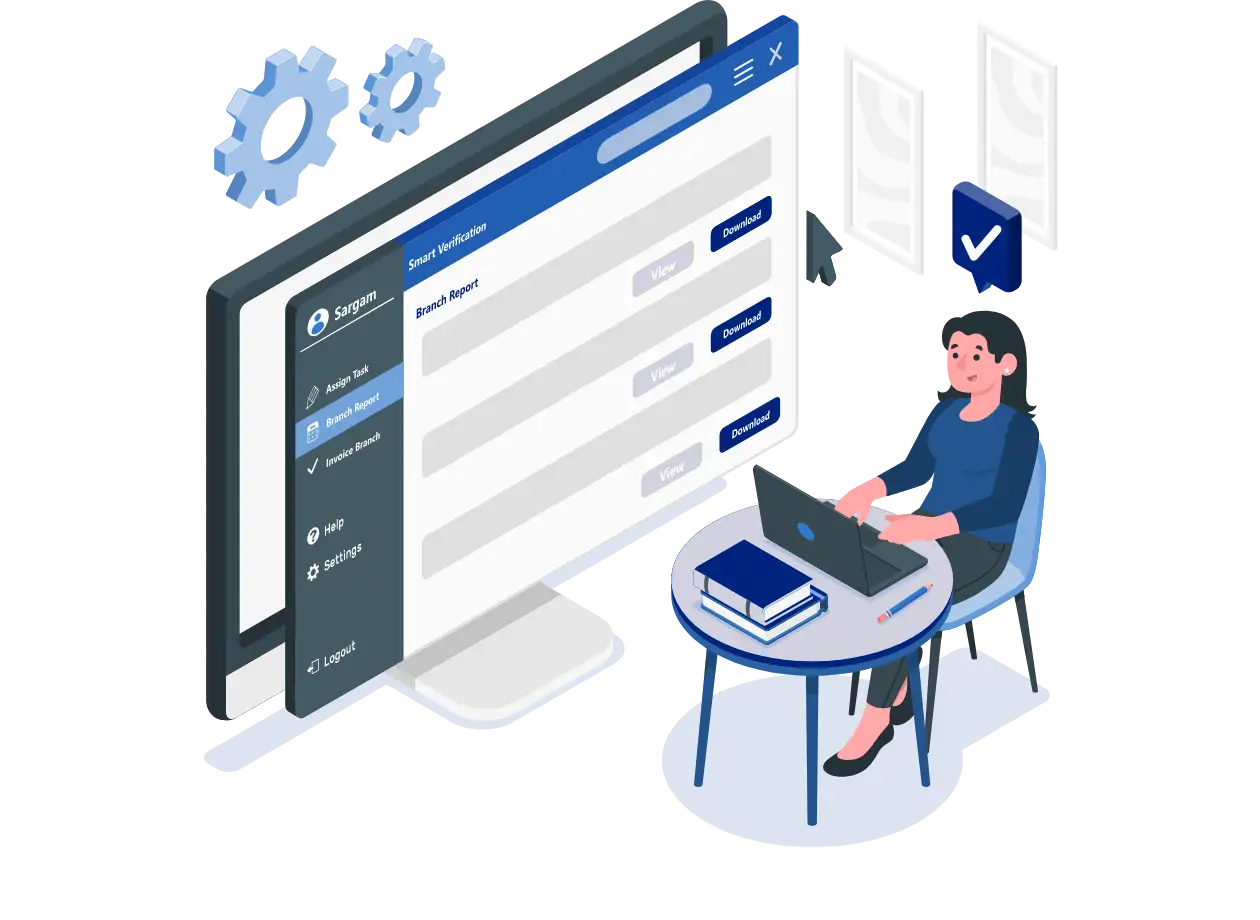

Smart Credit & OTC/PDD Tracker

Multiple Integrations

Solutions For

Who Can Use

goOriginate Loan Origination System supports

Clients Who Trust Us

Building relationships, delivering excellence

goOriginate - Digital Lending Solutions on the Go

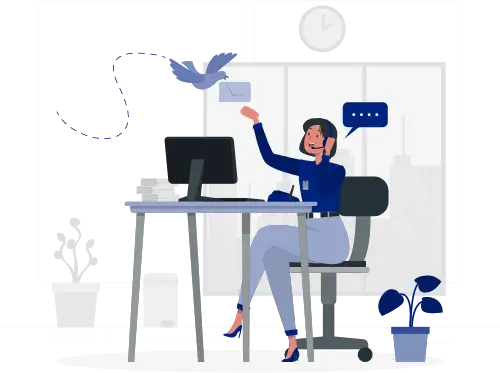

Credility’s goOriginate is a complete mobile app-based loan origination software solution. Organizations are constantly looking to make digital lending solutions and digital loan processing easier, but they face multiple challenges that affect customer service. Credility’s Loan Origination Systems come with sophisticated functionalities that make the app simple, informative and fast to process loans. Go paperless and eliminate the hassles of manual loan processing with goOriginate.

Our team of developers and coders have the domain expertise to configure this loan origination platform for NBFCs, Housing Finance, Loan Against Property (LAP), Business Loan and Auto Loan Origination. It is one of the most versatile loan software for lenders who want speed, accuracy and compliance in their digital workflows.

Services & Features of Loan Origination Software by Credility

goOriginate has credit evaluation apps for each department which works even in offline mode, making the entire digital lending software ecosystem super-efficient. Enjoy smooth, end-to-end digital loan processing with our powerful Credility Platform.

Lead Management App

Get a comprehensive lead management app for on-field Sales Agents. Generate and manage your leads efficiently, nurture them effectively and increase your pool of potential borrowers using this advanced loan origination solution.

Login File App

The Sales Team can complete eKYC, collect documents and generate a digital loan application form in real time. Our app is third-party integration-ready, enhancing overall loan origination system software performance.

Credit PD App

Understand customers better with structured questions and secure verification. goOriginate’s Credit PD App allows the capture of customer selfies, video recordings and key information necessary to evaluate eligibility. Our analytics offer deep insights into applicant profiles, strengthening credit underwriting software in India.

Sanction - Credit Approval App

Our credit approval app simplifies the acceptance or rejection of loan applications, helps decide loan limits and processes additional disbursements digitally. Review the data, analyze it and sanction applications instantly with Credility’s seamless loan origination systems.

Advantages of goOriginate – Loan Origination System by Credility

Credility is a mobility pioneer in financial services. Our robust, world-class mobile application solutions have transformed digital lending software and loan origination space.

Simple & Effective App

goOriginate is an intelligently developed loan origination platform. The app is smooth, fast and works offline without dependency on the network. From Lead to Sanction, departments can use different apps while files move digitally—making end-to-end loan origination completely paperless.

Fully Compatible with Existing Platforms

Our Loan Origination Systems integrate easily with any core lending system or platform for smooth functioning.

Seamless Enterprise Solution

Credility provides enterprise-level app solutions to financial organizations. Enjoy multiple user logins with admin controls to streamline digital loan processing activities.

Improve Efficiency

goOriginate’s smart loan origination system software brings all data and processes into a single interface. Employees and customers get information instantly at their fingertips, improving operational efficiency and supporting faster business growth.

Cutting-Edge Technology

Credility builds with modern technology to give clients the best digital experience. GoOriginate’s credit underwriting software in India is integrated with 10+ third-party APIs (PAN, Aadhaar, CIBIL, etc.) for faster onboarding. Features include user tracking, online/offline working and analytics. Compatible with both Android and iOS.

Customization

Every lending business has unique needs. goOriginate can be customized up to 20–30% based on your business requirements. Credility is a trusted name in the digital loan processing domain due to its premium mobile application development expertise. We take pride in delivering exceptional tech solutions with our CreditPD app for NBFCs and Housing Finance companies across India. Connect with us and let’s explore how we can empower your lending operations further.

Insights

Journey into insightful perspectives

Ready to Transform?

Reach out to our team for a personalized demo